Bitcoin Hits New Highs in UPtober

New Highs

Bitcoin prices are on watch today with the futures market seen printing a new record high of $125,450 earlier. The market has been on a steady run higher over the last week with BTC currently enjoying its sixth consecutive day in the green. The move comes amidst a firming up of traders’ dovish Fed expectations and has been helped by the uncertainty around the US government shutdown.

ETF Demand

Indeed, the latest industry data shows that Bitcoin ETFs recorded their second largest weekly net-inflows last week of $3.2 billion. The surge in institutional demand reflects the growing view that the market is primed for a fresh bull phase over Q4 as the Fed commits more fully to its easing cycle. It seems the government shutdown in the US is reinforcing this view with traders anticipating that the Fed might end up being forced to cut rates at faster pace than initially projected.

US Shutdown

With no progress so far on delivering an end to the shutdown, the current market uncertainty should keep BTC moving higher. Most US data will be delayed this week, leaving a bigger focus on the FOMC minutes midweek. Given that the minute should show a dovish skew, USD is likely to remain pressured with risk assets, BTC included, given the green light to continue higher here.

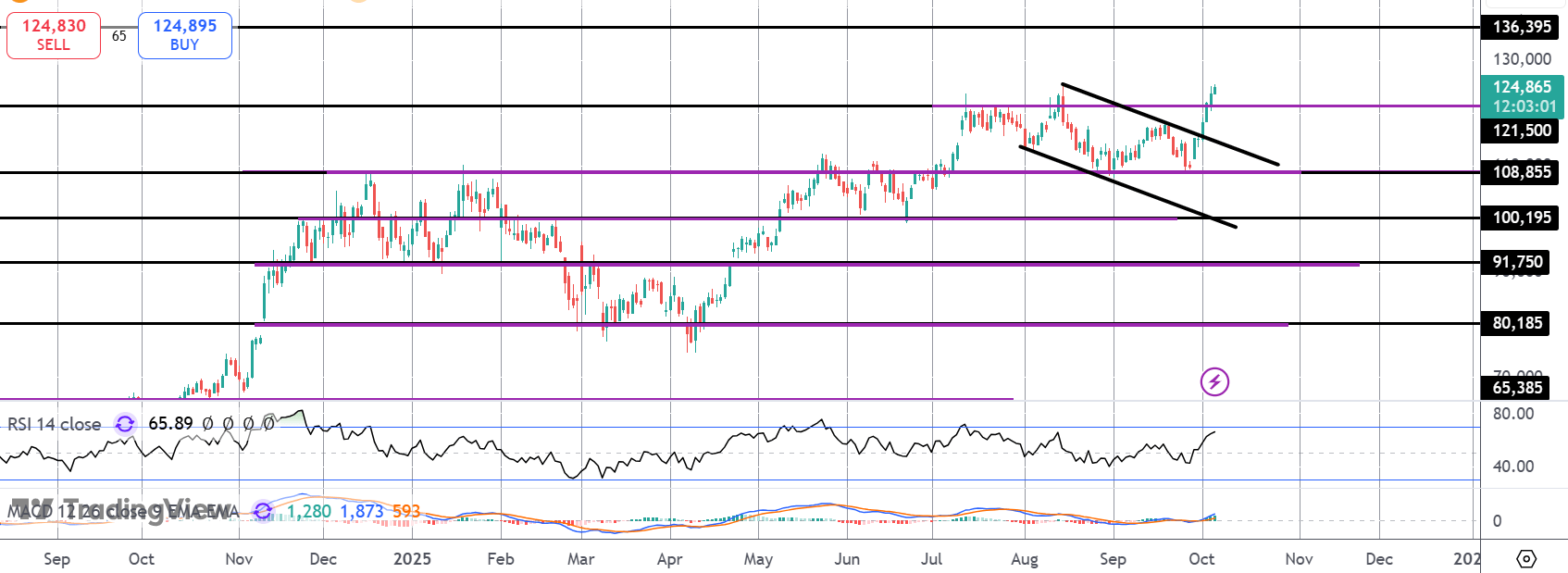

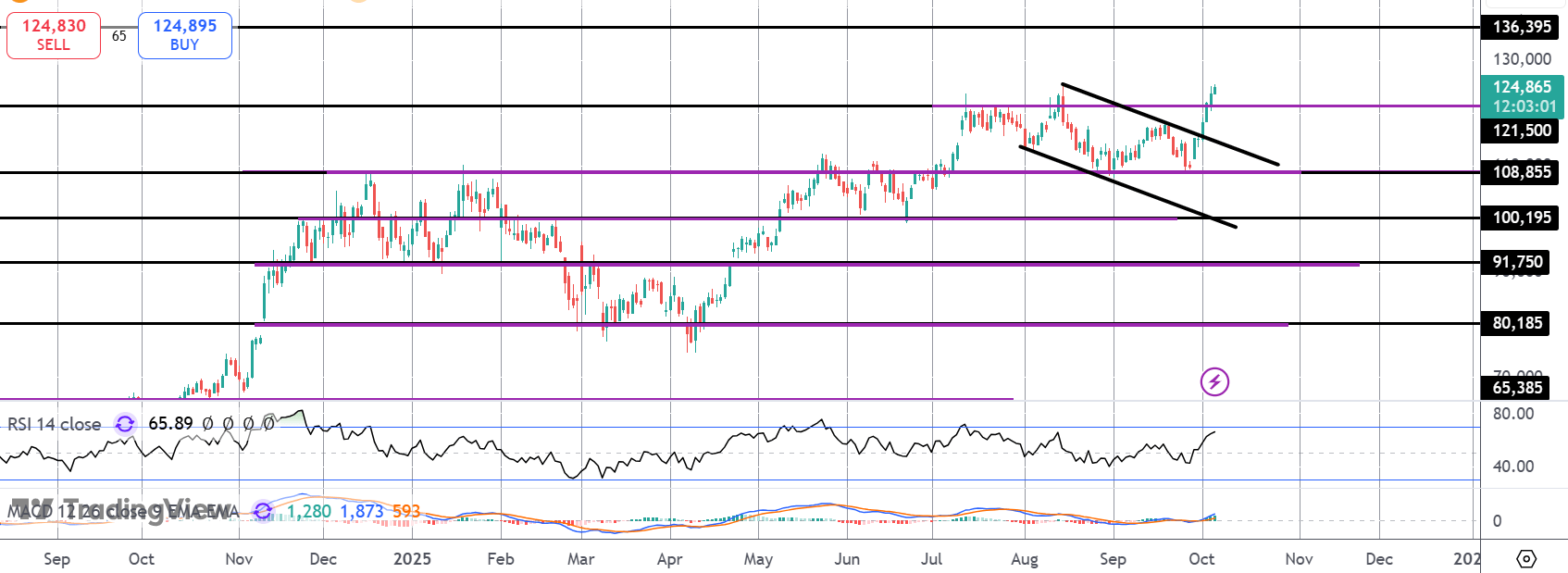

Technical Views

BTC

The rally in BTC has seen price breaking out above the corrective bear channel from former YTD highs. Price is now testing those highs and with momentum studies bullish, looks poised for a fresh breakout here. Above market, $136,395 is the next target for bulls with the current upside focus remaining intact while we hold above $121,500.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.