FTSE 100 FINISH LINE 7/10/25

FTSE 100 FINISH LINE 7/10/25

The FTSE 100 in London remained relatively stable on Tuesday as investors took a breather following the previous week's surge, with losses in the overall market counterbalanced by increases in key energy shares. Retail stocks took a hit, falling by 0.8%. B&M plummeted 5.5%, reaching its lowest point in over five years, as the discount retailer cautioned about a decline in its annual profit due to weak sales. This marked the largest drop on the FTSE 250 index. According to the latest report from Halifax, the growth in British housing prices was slower than anticipated at 1.3% over the past year, marking the weakest increase since April 2024. Homebuilders, such as Vistry and Bellway, also suffered losses, contributing to a 0.7% decline in the household goods and construction sector. Conversely, energy stocks rose by 1.3%, with oil giant Shell increasing by 1.6% after raising its forecast for third-quarter LNG production. The FTSE 100 had surged to record highs last week, buoyed by interest in battered healthcare stocks after the U.S. government reached an agreement with drug manufacturer Pfizer, alleviating some uncertainties in the sector. Although the benchmark reached an intraday record high on Monday, it retreated following the resignation of the French prime minister, which raised concerns about fiscal and political stability. Analysts predict that the markets will remain in a wait-and-see approach due to the lack of significant catalysts and the ongoing U.S. government shutdown.

Shell's stock increased by 1.9%, reaching 2790.5p. It is the second-largest gainer on the FTSE 100 index. The company has upgraded its Q3 LNG production forecast to between 7.0 and 7.4 million metric tons, up from the previous estimate of 6.7 to 7.3 million tons. It anticipates that Q3 trading results in its integrated gas division will be substantially higher than those in Q2. However, the company reported a $600 million loss due to the cancellation of its biofuels project in Rotterdam. As of the last closing, SHEL has seen an increase of over 10.5% year-to-date.

CVS Group has risen by 7.5% to 1,344p. The veterinary services provider reported a fiscal year adjusted EBITDA of 134.6 million pounds ($181 million), which represents a 9.4% year-over-year increase. The company stated that the new financial year is off to a "strong start." Panmure Liberum noted that, despite the ongoing CMA investigation, the company is "quietly continuing its operations and providing a great mix of solid growth and high service levels." They also mentioned that they still believe the remedies proposed by the CMA will be largely mild. Year-to-date, CVSG has gained approximately 63%.

Shares of discount retailer B&M have dropped approximately 22% to 200 pence, marking their lowest point since March 2020. They are the biggest percentage loser on the FTSE mid-cap index, which has declined 0.17%. The company anticipates a 28% decrease in first-half core earnings and a reduction in annual profit. B&M's revenue increased by 4% in the first half to £2.75 billion ($3.70 billion) year over year. As of the last closing, the stock has fallen 26.8% year-to-date, whereas the FTSE mid-cap index has risen 7% year-to-date.

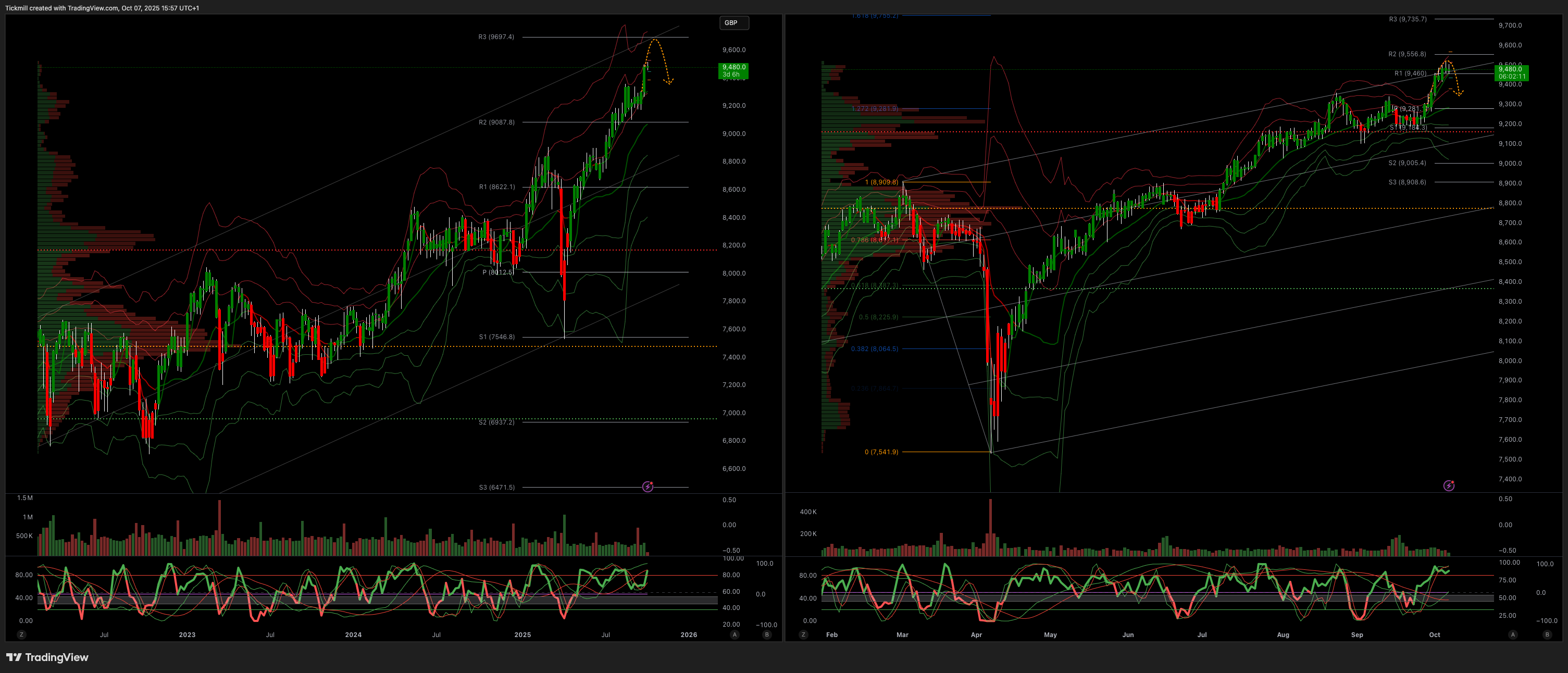

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!